Featured articles

Featured articles

Firm News

Hugh James celebrates significant promotions across its Cardiff, London and Manchester offices

01/05/2025

Comment

Featured articles

Major breakthrough for thousands in military hearing loss claims

08/07/2024

Firm News

See all articles

Featured articles

Firm News

Hugh James celebrates significant promotions across its Cardiff, London and Manchester offices

01/05/2025

Comment

See all articles

Comment

Family law insights

Supreme Court ruling in Standish v Standish: What it means for dividing assets on divorce

02/07/2025

Deals

See all articles

Sports Deals

WSA and Hugh James renew partnership to continue providing members with expert legal services

16/06/2025

Case Study

See all articlesCase Study

Military case studies

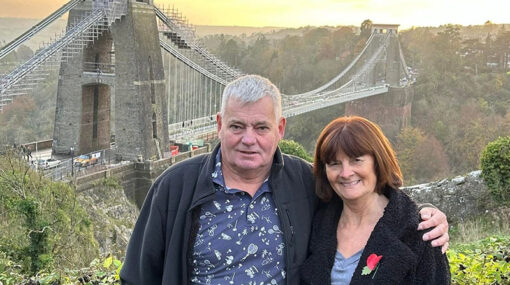

British soldier wins £450,000 for preventable non freezing cold injury

30/06/2025

Case Study

Medical negligence case studies

Family’s fight for answers leads to Prevention of Future Death report following death of Valerie Hill

27/06/2025

Case Study

Hospital negligence case studies

Medical negligence case studies

Parents of 4-day-old Etta Lili Stockwell-Parry say lives were turned “upside down” by care failures that led to her avoidable death

05/06/2025

Case Study

Military case studies

Preventable non-freezing cold injuries suffered by military personnel

25/02/2025

Asbestos & mesothelioma case studies

Case Study

Father of three David Squires determined to live life to the fullest despite mesothelioma

04/02/2025

Witness Appeals

See all articlesWitness Appeals

Asbestos exposure at laundry factory in Birmingham – Did you work with Mr David Ward?

01/07/2025

Witness Appeals

Former Miners and their families represented by Hugh James sought for BBC Documentary

20/05/2025

Witness Appeals

Witness Appeal: Did you work with Ronald March O’Halleron (known as Ron) at St Anthony’s Tar Plant?

07/05/2025

Podcasts

See all articlesCharities, Community, & CSR

See all articles

Charities, Community, & CSR

Firm News

From sky to support: Alan’s skydive for Trust House and We-Together

26/11/2024

Charities, Community, & CSR

Firm News

Hugh James Rugby Lunch 2024 raises £29k for charity partners

15/11/2024

Charities, Community, & CSR

A memorable day in Horatio’s Garden: Treasure hunt and afternoon tea

26/06/2024

Charities, Community, & CSR

Hugh James continues to support Horatio’s Garden Wales | Nurturing the wellbeing of people after spinal injury

21/05/2024

Webinars

See all articles