Featured articles

Featured articles

Firm News

Hugh James celebrates significant promotions across its Cardiff, London and Manchester offices

01/05/2025

Comment

Featured articles

Major breakthrough for thousands in military hearing loss claims

08/07/2024

Firm News

See all articles

Featured articles

Firm News

Hugh James celebrates significant promotions across its Cardiff, London and Manchester offices

01/05/2025

Firm News

Hugh James reappointed to major four-year Welsh Government Legal Services framework

19/03/2025

Comment

See all articles

Comment

Sports insights

Concussion in sport: What governing bodies need to learn from Will Pucovski’s retirement and ongoing litigation

06/05/2025

Comment

Family law insights

Who gets the dog? The changing role of pets in divorce settlements

10/04/2025

Deals

See all articles

Case Study

See all articles

Case Study

Military case studies

Preventable non-freezing cold injuries suffered by military personnel

25/02/2025

Asbestos & mesothelioma case studies

Case Study

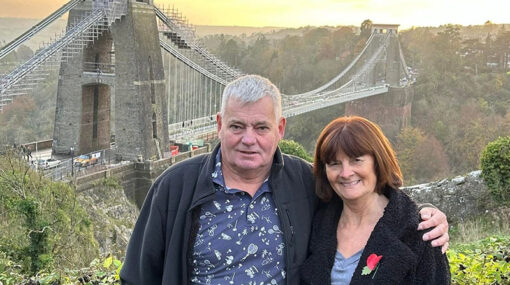

Father of three David Squires determined to live life to the fullest despite mesothelioma

04/02/2025

Financial miss-selling case studies

Veteran secures £59,973 Compensation for Mis-Sold Armed Forces Pension Transfer

02/01/2025

Case Study

Nursing care case studies

Securing justice: How we helped a spinal injury survivor receive NHS-funded care at home

02/12/2024

Case Study

Military case studies

Significant Settlement Achieved in Noise Induced Hearing Loss Case Against Ministry of Defence

26/11/2024

Webinars

See all articles

Podcasts

See all articlesWitness Appeals

See all articles

Witness Appeals

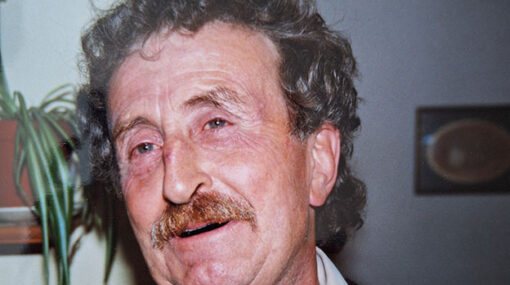

Witness Appeal: Did you work with Ronald March O’Halleron (known as Ron) at St Anthony’s Tar Plant?

07/05/2025

Witness Appeals

Witness appeal launched following death of former scientific officer from asbestos-related cancer

28/03/2025

Witness Appeals

Witness appeal: Asbestos exposure at the Department of Engineering, University of Cambridge

20/02/2025

Charities, Community, & CSR

See all articles

Charities, Community, & CSR

Firm News

From sky to support: Alan’s skydive for Trust House and We-Together

26/11/2024

Charities, Community, & CSR

Firm News

Hugh James Rugby Lunch 2024 raises £29k for charity partners

15/11/2024

Charities, Community, & CSR

A memorable day in Horatio’s Garden: Treasure hunt and afternoon tea

26/06/2024

Charities, Community, & CSR

Hugh James continues to support Horatio’s Garden Wales | Nurturing the wellbeing of people after spinal injury

21/05/2024

Charities, Community, & CSR

Brake’s “Beep Beep! Day” for road safety – saving little lives

24/04/2024