Featured articles

Comment

Featured articles

Ministry of Defence extends deadline for £50bn Military Deafness Claims

20/01/2026

Comment

Featured articles

MoD Matrix Agreement: Major breakthrough for thousands in military hearing loss claims

08/07/2024

Firm News

See all articles

Firm News

Social housing insights

Wales outperforms the UK housing market – Savills Welsh Housing Market and Supply Update launched at Housing Week 2025

14/11/2025

Comment

See all articles

Comment

Family law insights

Divorce in business: Why collaboration is the smartest asset you own

29/01/2026

Deals

See all articles

Deals

Sports Deals

Hugh James advises OffPitch Sports International on first investment round

09/09/2025

Charities, Community, & CSR

See all articles

Charities, Community, & CSR

Firm News

Hugh James Rugby Lunch 2024 raises £29k for charity partners

15/11/2024

Charities, Community, & CSR

A memorable day in Horatio’s Garden: Treasure hunt and afternoon tea

26/06/2024

Charities, Community, & CSR

Hugh James continues to support Horatio’s Garden Wales | Nurturing the wellbeing of people after spinal injury

21/05/2024

Case Study

See all articlesCase Study

Serious injury case studies

Substantial settlement for woman left with disabling neurological injury following road traffic collision

12/02/2026

Case Study

Serious injury case studies

Mother sustained a severe brain injury after she and her toddler were involved in a traffic collision on the motorway

04/02/2026

Case Study

Serious injury case studies

Over £3 million settlement for young woman who suffered a serious brain injury when hit by a car whilst jogging

30/01/2026

Case Study

Serious injury case studies

Father of six-year-old girl killed in tragic road traffic accident recovers damages for severe and ongoing PTSD

21/01/2026

Case Study

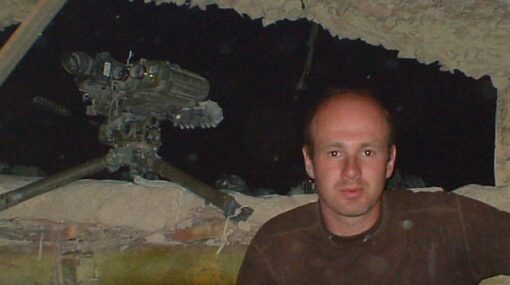

Military case studies

Substantial settlement for soldier with noise induced hearing loss

13/01/2026

Witness Appeals

See all articles

Witness Appeals

Witness Appeal: Did you work with Ian Stoneley at Imperial Chemicals Ltd?

07/01/2026

Witness Appeals

Witness Appeal: Did you work with Mr Arthur Mott at Hotpoint in the late 1960s?

04/12/2025

Witness Appeals

Witness Appeal: Did you work with Mrs Christine King at West Cornwall Hospital in Penzance

01/12/2025

Witness Appeals

Witness Appeal: Did you work with Dennis Baxter at Apex Insulation or London Regional Transport?

13/11/2025

Witness Appeals

Witness appeal: Did you work with Mr Andrew Horton at the Inland Revenue Building in Llanishen, Cardiff?

23/10/2025

Witness Appeals

Witness appeal: Did you work with Mr Denis Tapp at a Dockyard in Plymouth?

07/10/2025